Purchasing property in Ontario is already a costly venture, with property values reaching new highs seemingly every year. In addition to the cost of the property itself, there are other fees to consider, including legal costs, and the provincial land transfer tax, which is calculated on a scale based on the purchase price of the property.

In 2008, the City of Toronto exercised its right under the City of Toronto Act to create a second land transfer tax payable to the City on all purchases of land within the city limits. The tax is charged at the same rate as the provincial tax, effectively doubling the tax liability for all purchasers of commercial and residential land. Toronto is the only municipality permitted to seek broader revenue streams than every other municipality in the province, thanks to special permissions granted through the City of Toronto Act. However, other municipalities may soon seek to implement the same tax structure, based on a recent meeting of the North Bay City Council.

Tax Could Help Reduce Province-Wide Infrastructure Deficit

Ontario is currently experiencing an infrastructure deficit, totalling approximately $6 billion, according to the Association of Municipalities Ontario, no doubt impacted in part by the prolonged closure of income-generating functions such as community centres and youth sports programs due to Covid-19. In an effort to generate new revenue streams, North Bay City Councillor Mac Bain recently proposed a motion seeking an order from the Premiere to grant all municipalities in the province the same abilities with respect to revenue generation currently afforded to the City of Toronto.

Councillor Bain said that annual property taxes are no longer sufficient to allow municipalities to address the deficit, creating a need to generate new revenue streams. In 2020 alone, the City of Toronto collected $800 million from municipal land transfer taxes. If allowed to do the same, it’s projected that the rest of Ontario’s towns and cities could generate over $2.5 billion.

How is Municipal Land Transfer Tax Calculated?

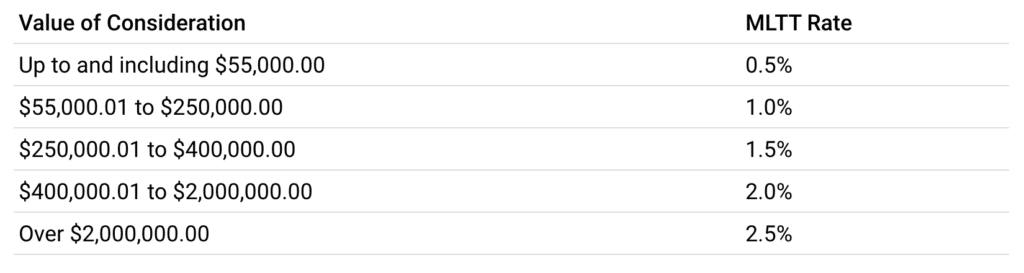

Municipal land transfer tax is charged in incremental stages based on the purchase price of the property in question. For example, the first $55,000 is charged at a rate of 0.5%, while the value of a home from $55,000.01 to $250,000 is charged at a rate of 1%. The highest rate, charged on single-family homes valued in excess of $2 million, is 2.5%. A home with a purchase price of $800,000 would result in taxes amounting to $12,475.00 for the municipality, and the same amount for provincial land transfer tax, totalling $24,950.00.

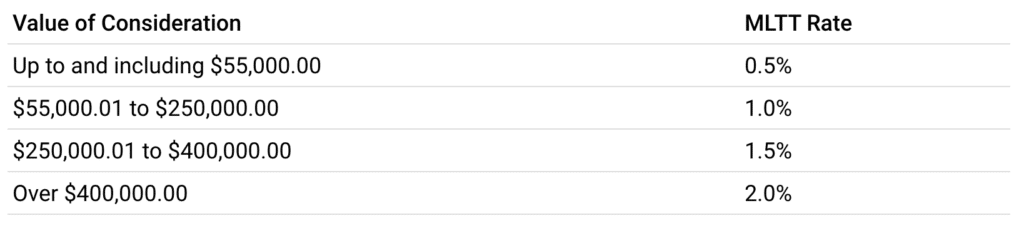

Below are the full taxation rates for both single-family homes and other properties.

For property containing at least one, but not more than two, single-family residences, the tax is calculated as follows:

For all other non-single family residences with a consideration value of:

Municipal Land Transfer Tax Rebate Entitlements

As with the provincial land transfer tax, some purchasers are eligible for rebates on the municipal land transfer tax paid. First-time homebuyers of resale or new construction single-family homes are entitled to a rebate of up to $4,475.00. First-time homebuyers are defined as follows:

- The buyer must be at least 18 years of age;

- The buyer must use the property as their principal residence within 9 months of the conveyance;

- The buyer cannot have had a previous ownership interest in a property anywhere in the world, at any time;

- If the buyer has a spouse, the spouse cannot have had a previous ownership interest in any property, anywhere in the world, while the buyer was their spouse; and

- The buyer must be a Canadian citizen or permanent resident. If the buyer becomes a citizen or permanent resident within 18 months of purchasing the proeprty, they may apply for a rebate at that time.

Notably, the rebate is not available on the purchase of commercial or industrial properties or multi-family dwellings.

Contact Tierney Stauffer LLP in North Bay, Ottawa & Eastern Ontario for Experienced Representation in Commercial & Residential Real Estate Transactions

It remains to be seen whether Councillor Bain’s motion will be approved, and if so, whether other municipalities throughout Ontario will adopt the municipal land transfer tax. However, if the motion does move ahead, those purchasing property will need to consider the fact that their land transfer tax obligation may double in the near future.

At Tierney Stauffer LLP, we pride ourselves on our client-focused and personalized approach to residential real estate matters. Our real estate law team has extensive and broad experience representing clients on a variety of commercial and residential real estate matters and will ensure nothing is overlooked leading up to the closing of a transaction. Call us at 1-888-799-8057 or contact us online to set up a consultation with an experienced real estate lawyer.